How to Maximize the Tax Benefits of Donating

Federal and provincial donation tax credits add up

Reduce Capital Gains Taxes

Carry previous donations forward for a larger tax credit

See the difference that charitable donation tax credits make when you donate to your favourite charity and claim your donation receipts. Not only is giving to charity a great way to make a difference to your favourite cause, but when you claim your charitable tax credits you can also take advantage of federal and provincial government tax incentives. Calculate your savings below.

|

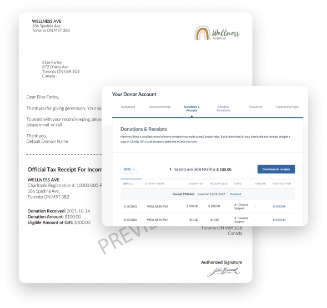

Instant tax receipts

CanadaHelps automatically emails you a copy of your tax receipt each time you make a donation – whether you have an account with us or not. |

|

Anytime access to your charitable receipts

Have a CanadaHelps account? Your receipts are stored securely in your account so you can access them at any time. Even without an account, you can access previous years’ receipts using our receipt download tool. |

|

Choose how you want your tax receipts

With a CanadaHelps account, you can choose to receive a single receipt each time you make a donation or an aggregated, single roll-up receipt for all your donations. No need to keep track of your tax receipts – CanadaHelps does that for you! |

|

Create a strategic giving plan just for you

Don’t get caught by the December 31 deadline! Use your CanadaHelps account to plan your giving for the year. Set up a monthly gift that is more manageable for your budget, track your donations, and set giving goals for your year. |

Report it on your electronic federal and provincial tax return or on schedule 9 of paper tax returns. Generally, at the federal level, you are credited 15% of the first $200 of donations and 29% of additional donations above the first $200. Provincial donation tax credits on the first $200 and amounts above the first $200 range between 4% to 25%.

In one year, you can claim a maximum of 75% of your net income. The ability to carry forward charitable donation credits means if you reach the maximum claim amount this year, you can always claim amounts left over next year.